Investor Profiles Compared: Who Buys in Dubai, Miami, and New York — and Why

Investor Profile Fit – Who Buys in Each City and Why

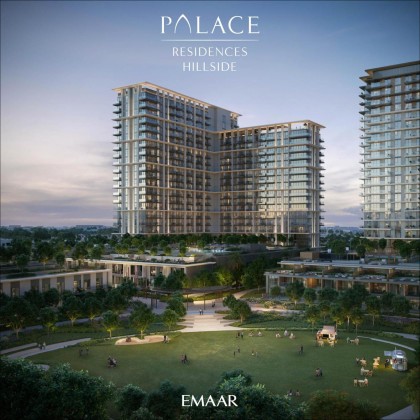

Dubai

Dubai attracts international capital: GCC investors, Indian buyers, Russian / CIS wealth, Chinese capital, Europeans, and high-net-worth individuals who do not necessarily live in the UAE full-time. The core motivation is financial: investors want high rental yield relative to purchase price, exposure to a dollar-pegged currency (AED is pegged to USD), and a straightforward path to residency such as the UAE Golden Visa through property ownership at certain price brackets. Dubai is openly marketed to global investors — including people who have never lived there and may never move in.

Miami

Miami attracts three types of money at the same time:

U.S. domestic wealth relocating from high-tax states like New York and California

Latin American capital looking for a politically stable, USD-denominated safe zone

Global lifestyle buyers (Europe, Middle East) who want warm-weather waterfront plus U.S. legal protection

Miami is seen as a “live it and rent it” market: you can personally use the property, then rent it out furnished, sometimes short-term, with real cash flow. The emotional component (lifestyle, Miami brand, waterfront) and the financial component (rental income in dollars) are both strong.

New York

New York — especially Manhattan — behaves like a global vault. Buyers include ultra-high-net-worth individuals, family offices, private equity, institutional money, and wealthy professionals in finance, media, tech, and law. Many of these buyers are not chasing monthly cash flow. They are parking capital in a world-status location with a deep legal system. New York property is treated like a prestige-grade, dollar-denominated store of value. For many buyers, owning in Manhattan is almost like owning a blue-chip asset: it signals credibility and operates as long-term capital preservation.

Summary of fit:

Dubai: “international investor looking for yield + residency + tax efficiency.”

Miami: “lifestyle investor who still wants real cash flow inside the U.S. system.”

New York: “capital preservation and prestige inside the most famous financial city in the U.S.”