How to Identify High-Rental Yield Areas in Dubai

Dubai continues to be a top destination for property investors, thanks to its strong rental market, tax-friendly policies, and diverse tenant base. For those looking to maximize rental income, identifying high-rental yield areas in Dubai is essential for long-term success. A rental yield refers to the annual rental income expressed as a percentage of the property’s purchase price.

Understanding how to evaluate potential areas based on demand, affordability, tenant trends, and infrastructure is key to making profitable real estate decisions.

1. Understand What Affects Rental Yield

Before choosing a location, investors should understand the factors that directly impact rental yields in Dubai:

-

Property purchase price: Lower entry prices with solid rental demand often produce better yields.

-

Rental demand: Proximity to business hubs, schools, or transport links increases occupancy rates.

-

Tenant demographics: Young professionals, families, and tourists have varying location preferences and budgets.

-

Community amenities: Areas with gyms, retail, and leisure options attract higher-paying tenants.

2. Use Data-Backed Sources

Leverage tools like Dubai Land Department (DLD) reports, RERA rental index, and DXBinteract for up-to-date transaction records, pricing, and rental return estimates. These platforms provide insight into rental market trends across different communities and help validate yield calculations.

For accurate returns, calculate gross rental yield using:

(Annual rental income ÷ Property purchase price) × 100

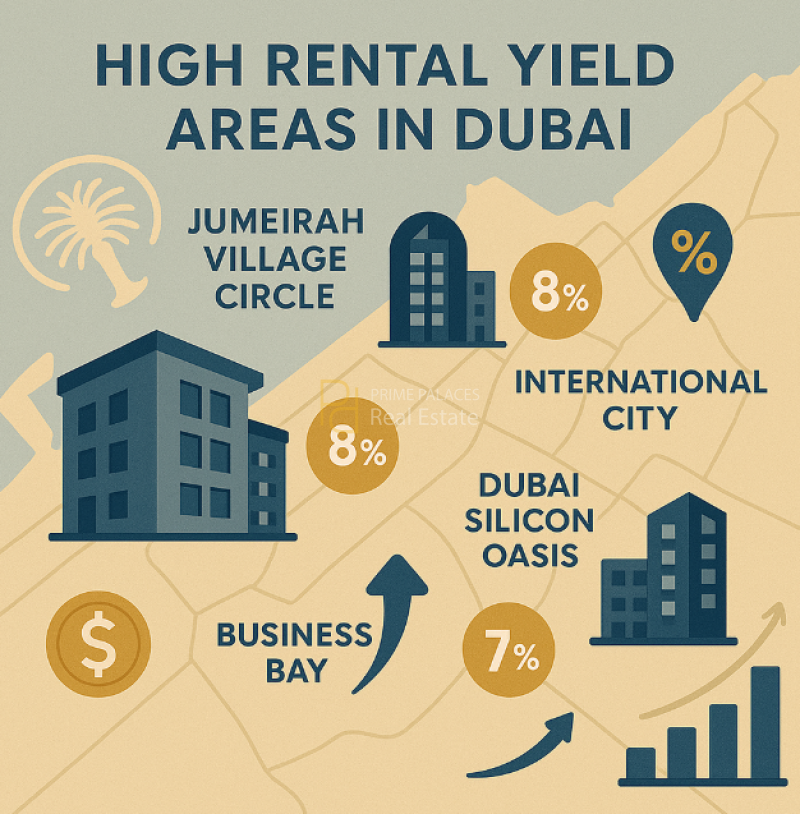

3. Top High-Yield Areas in Dubai

Jumeirah Village Circle (JVC)

One of the top-performing rental zones due to affordability and high tenant turnover. Studios and one-bedroom units offer rental yields of 7–9%, especially for investors focused on the mid-market segment.

Dubai Silicon Oasis

Popular with families and tech professionals, it offers consistent rental demand, especially for apartments. Yields typically range between 6–8%.

International City

Despite its lower price point, International City has one of the highest rental yields in Dubai, often exceeding 9% for studio and one-bedroom units.

Dubai Sports City

With demand from young professionals and athletes, this area provides steady occupancy and yields of around 7%, supported by lifestyle amenities and accessibility.

Business Bay

Though more premium, it maintains a strong rental market due to its proximity to Downtown Dubai and the canal. High-end studios and one-bedrooms provide yields of 6–7%.

4. Monitor New Supply and Tenant Trends

Track future supply pipelines and upcoming infrastructure. Areas with rising inventory may see short-term rent pressure, affecting yields. Conversely, new metro expansions or mall openings can drive future rent growth in underpriced areas.

5. Work With RERA-Certified Brokers

Partnering with a licensed RERA broker ensures access to verified listings, realistic projections, and compliance with Dubai’s real estate regulations. These professionals can also guide you through lease structures, tenant screening, and post-purchase management.

Conclusion

Identifying high-rental yield areas in Dubai requires more than a low price tag—it involves analyzing tenant demand, infrastructure, and community potential. By leveraging data, focusing on emerging neighborhoods, and applying strategic due diligence, investors can generate consistent rental income and optimize returns in one of the world’s most dynamic real estate markets.